Biocon (₹305.2)

Signs of bullish reversal

Biocon’s long-term downtrend, that began in December 2020, came to an end in April 2023 after it found support at around ₹200. Since then, the stock has been on a recovery. Importantly, before a couple of weeks, Biocon’s stock broke out of a key resistance at ₹290, forming a higher high. Thus, the price action indicates that the stock is likely to appreciate further from here. Nearest notable resistance is at ₹380.

So, we recommend buying the stock of Biocon now at ₹305 and accumulate if it dips to ₹290. Initial stop-loss can be at ₹275. When the stock rises past the possible hurdle at ₹325, alter the stop-loss to ₹300. When the price hits ₹350, tighten the stop-loss further to ₹335. Book profits at ₹375.

Great Eastern Shipping (₹1,035)

Bull flag breakout

The Great Eastern Shipping stock was moving across a sideways band since the beginning of this year. But a fortnight ago, it broke out of the range, opening the door for further rally. The daily chart shows that the stock has confirmed a bull flag pattern, according to which, the price is likely to surge to ₹1,350 in the near term.

That said, the price might see a dip to ₹980 from here before the rally. So, we suggest going long now at ₹1,035 and add more shares in case the price dips to ₹980. Place stop-loss at ₹880 initially. When the stock surpasses ₹1,150, raise the stop-loss to ₹1,090. Further tighten the stop-loss to ₹1,190 when the price touches ₹1,250. Liquidate the longs at ₹1,350.

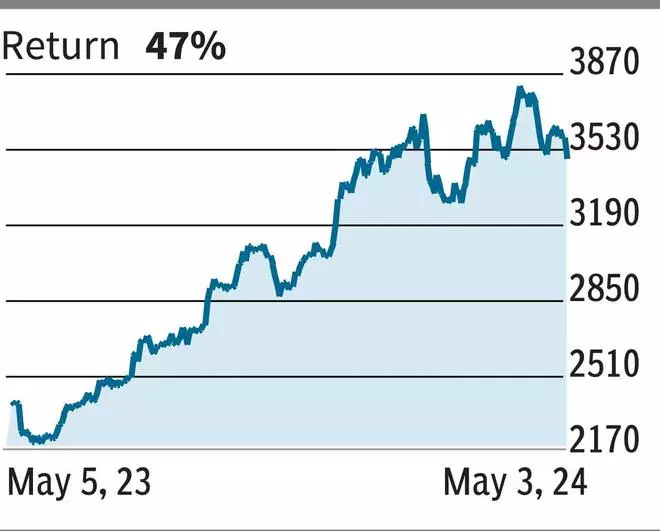

L&T (₹3,499.1)

Head & Shoulder reversal pattern

L&T’s stock, which is on a long-term uptrend, hit a record high of ₹3,860 in early April. But since then, it has been on a descent. While the long-term trend is still positive, there can be some weakness in the near future. The formation of a Head & Shoulder reversal pattern on the daily chart strengthens the case for a short-term decline in price, potentially to ₹3,100. But ₹3,280 is a good base.

Nevertheless, only a breach of the support at ₹3,480 will confirm the pattern. Therefore, traders can stay on the fence and initiate fresh short positions if the stock slips below the support at ₹3,480. Place stop-loss at ₹3,600 initially. When the price moderates below ₹3,380, tighten the stop-loss to ₹3,460. Exit at ₹3,280.

Crime Today News | Markets | Commodities | Forex | Stocks

Source | Powered by Yes Mom Hosting

Crime Today News Agency