<!–

–>

Boost in manufacturing exports for sustained current account surpluses is a must while maintaining prowess in service exports and remittances

Published Date – 19 April 2024, 11:57 PM

By Dr Vaishnavi Sharma & Dr Kedar Vishnu

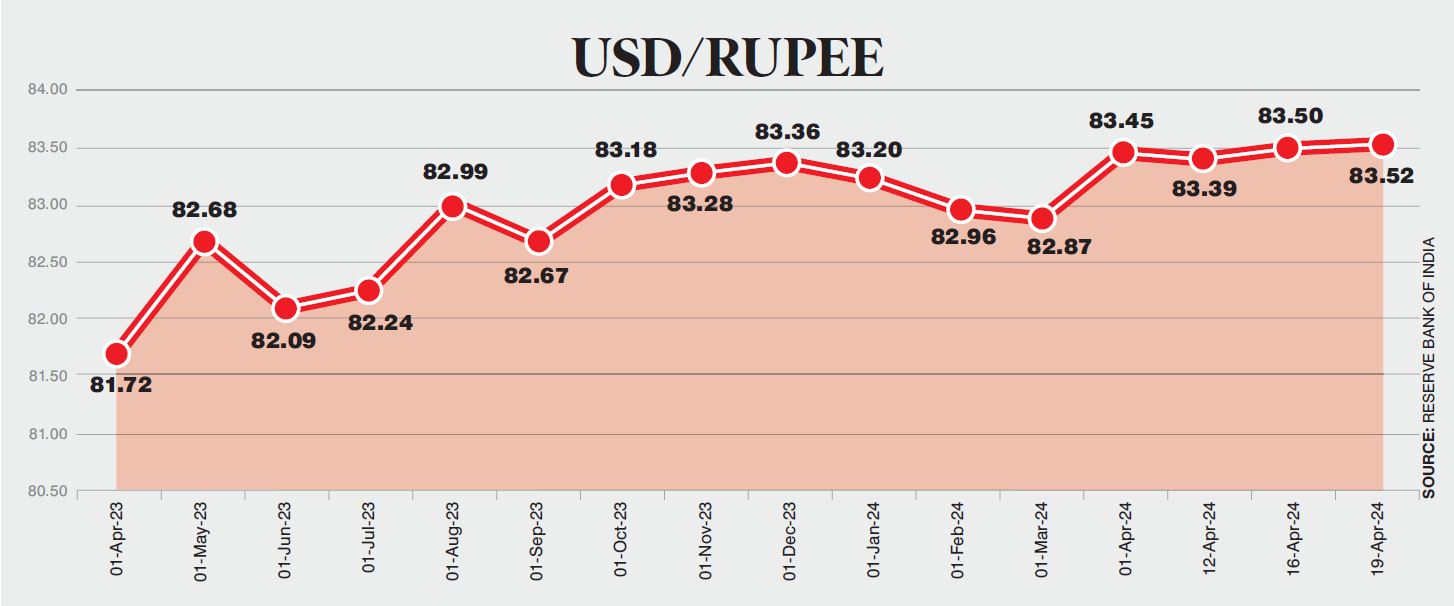

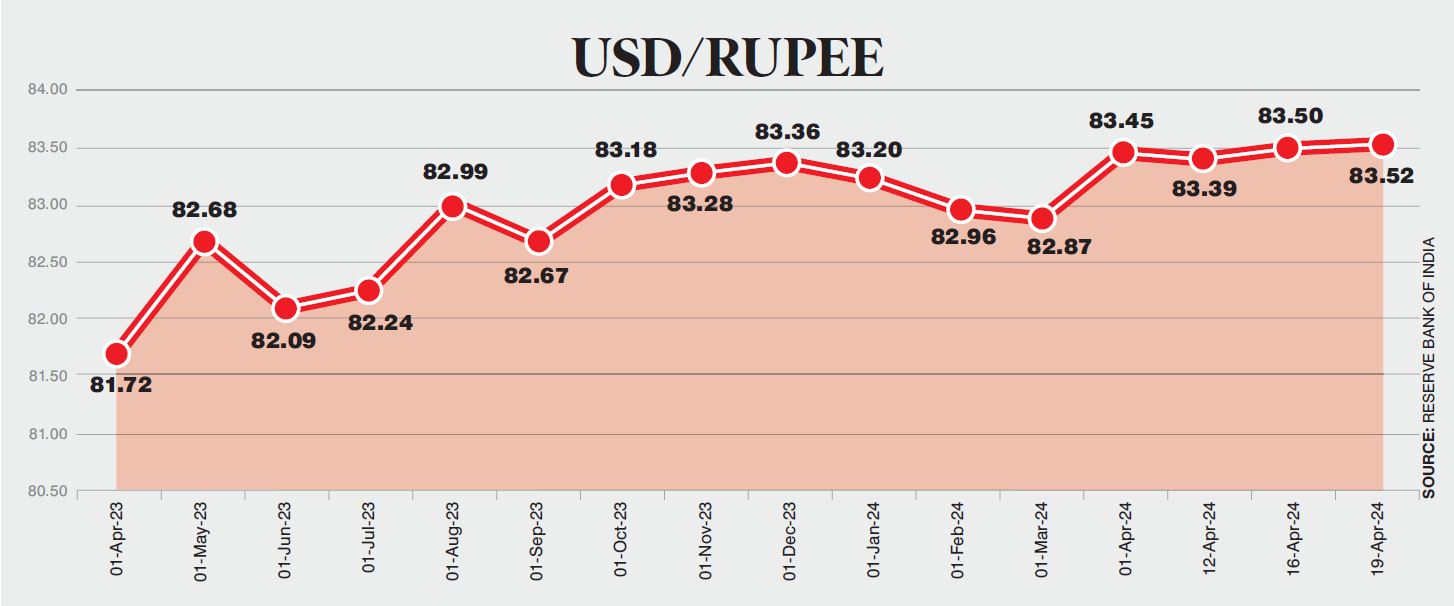

The rupee hit a historic low of 83.52 against the US dollar (USD) on April 19, 2024. It, however, saw a slight improvement of 20 paise on April 10. The rupee had previously hit an all-time low of 83.39 on November 13, 2023. Policymakers have expressed concerns regarding the consistent decline in the value of the rupee against the USD since January 2022.

Despite the rupee being ranked among the world’s top 15 most valuable currencies, the exchange rate between the rupee and the dollar has exhibited significant volatility over the past two years. What repercussions will the devaluation of the rupee against the USD have on our economy, and what measures has the RBI undertaken to mitigate the rupee’s historically low value against the USD? These are significant concerns that need to be addressed.

From Fixed to Flexible

Before 1944, there was no international oversight of currency exchanges, leading many countries to manipulate their currency values for trade advantage. The Bretton Woods meeting in July 1944 aimed to establish a stable foreign exchange system, prevent currency devaluations and foster global economic growth.

The International Monetary Fund (IMF) was established in 1945 to oversee the fixed exchange rate system. India followed this system from 1945 to 1973 before transitioning to a flexible exchange rate, determined by market demand and supply of rupee.

Under a fixed exchange rate, the Reserve Bank of India (RBI) ensured the rupee’s value matched the IMF rate by adjusting the money supply. Most major economies once embraced this fixed exchange rate system. The IMF’s proposed mechanism was found to be ineffective, as many member countries began devaluing their currencies against the USD in the early 70s. This failure was primarily due to the heightened demand for the USD worldwide.

The rupee was pegged at 4.79 against the dollar between 1948 and 1966.

Decades of 60s-80s

The 1960s witnessed economic stress with a decline in food and industrial production exacerbated by the subsequent wars with China and Pakistan, culminating in a balance of payments crisis. This led to a sharp devaluation of the rupee, dropping its value from approximately Rs 4 in 1966 against the USD to about Rs 7.6 in 1973. In the history of the Indian economy, the rupee was devalued for the first time by 57% on 6 June 1966 to increase exports. The oil crisis also adversely influenced the value of the rupee. It further depreciated against the USD in the 60s and 70s.

The 1980s experienced a lot of fluctuation: the rupee saw further devaluation from 8.06 in January 1981 to 16.84 in December 1989, dropping to a rate of 10 against the USD.

Era of Opening up

In June 1991, India encountered a severe balance of payments crisis, prompting a further devaluation to 21.20 against the USD. The pivotal year of 1993 witnessed a crucial turning point in the Indian currency history. During this time, the currency was allowed to float freely according to market sentiments.

Exchange rates were determined by market forces, with provisions for central bank intervention in times of extreme volatility. The rupee underwent a steady depreciation, hitting 31.37 against the USD by June 1993 following a consistent decline since 1991. Multiple devaluations were carried out during this period to bolster exports and attract increased foreign direct investment (FDI) to India.

Throughout the 1990s, its value dropped by approximately 22.50 rupees against the USD.

2000s and 2010s

During this period, the rupee fluctuated within the range of 40 to 51 against the USD, with its value predominantly hovering around 45. The global financial crisis of 2008 saw a slight appreciation in the value of the rupee. However, post-2012, the rupee has never appreciated beyond Rs 53 against 1 USD. We see that, over these 77 years, the rupee’s value has depreciated substantially, reaching around Rs 79-84 against the USD.

Various Factors

The depreciation of the rupee against the USD can be attributed to various global and domestic factors. International tensions such as the Russia-Ukraine conflict, coupled with the surge in crude oil prices (leading to a substantial increase in the trade deficit), have exerted pressure on the rupee. Additionally, the tightening of global financial conditions, including increased demand for USD from oil importers and concerns over trade deficits, has further contributed to its decline.

Moreover, actions taken by the US Federal Reserve’s interest rate hikes, have fuelled market uncertainties, worsened by geopolitical conflicts and economic uncertainties in regions like Europe and China amid the Covid-19 pandemic. These uncertainties triggered a sell-off in global equity markets, leading to the exodus of USD, impacting the rupee negatively.

The RBI’s measures to curb inflation through monetary policy tightening and increase its reserves to cushion against any future turbulence have also played a role in the rupee’s devaluation. The combination of high crude oil prices, equity market downturns and monetary policy adjustments has led to a negative outflow of USD, further weakening the rupee in the foreign exchange markets.

Way Forward

While the USD remains dominant globally, its influence may be gradually declining. With the RBI’s credibility, the rupee could gain international recognition. With India’s exemplary growth rate in recent times, coupled with the significant increase in cross-border spending and a continuous rise in exports, the rupee has the potential to emerge as a prominent player in the global currency arena.

To realise this, one of the primary requisites is to address the persistent current account deficit. India must prioritise a substantial boost in manufacturing exports to foster sustained current account surpluses over time, while simultaneously maintaining its prowess in service exports and remittances.

Collaboration between the central bank and the central government is essential. It is anticipated that the RBI will likely raise the repo rate to diminish the rupee supply in the economy and may also sell some foreign exchange reserves in the international market to increase the dollar supply in the near future. The RBI needs to uphold prudent monetary policies to cultivate an environment conducive to investment. Additionally, strengthening financial infrastructure and implementing initiatives to bolster manufacturing, promote innovation, and enhance competitiveness are crucial for fostering export-led growth and establishing the rupee as a reliable currency on the global stage.

(Dr Vaishnavi Sharma is an Economist with a PhD from Indira Gandhi Institute of Development Research (IGIDR), Mumbai. Dr Kedar Vishnu is an Assistant Professor of Economics at Narsee Monjee Institute of Management Studies, Mumbai)

<!–

–>

Source | Powered by Yes Mom Hosting