The stars may be aligning for a record year of initial public offerings (IPOs) led by large share sales.

The average issue size for IPOs this fiscal may end up being double or even triple of last year (₹815 crore) when a number of small and mid-sized companies hit the market. This figure was ₹1,409 crore in FY23 and ₹2,105 crore in FY22.

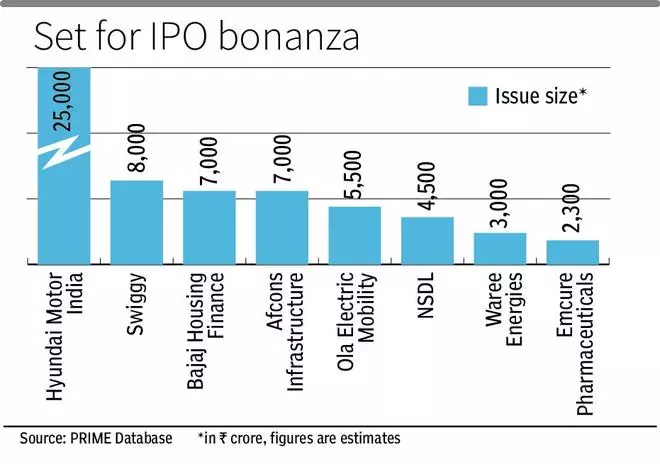

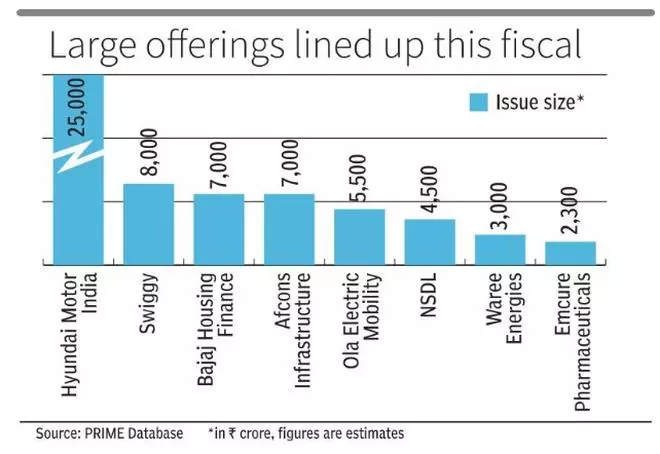

Hyundai Motor India, the Indian arm of the South Korean auto major, alone may garner about ₹25,000 crore, beating the earlier record set by LIC, which mopped up ₹21,000 crore in FY23.

Bajaj Housing Finance (₹7,000 crore), Swiggy (₹8,000 crore), Afcons Infrastructure (₹7,000 crore), Ola Electric Mobility (₹5,500 crore), NSDL (₹4,500 crore) and Waree Energies (₹3,000 crore) are some of the other prominent names that could come to the market this fiscal.

The largest IPO in FY24 was from Mankind Pharma (₹4,326 crore), followed by Tata Technologies (₹3,043 crore) and JSW Infrastructure (₹2,800 crore). Already, in FY25, eight firms have raised over ₹14,600 crore, with Bharti Hexacom’s ₹4,275-crore IPO leading the way.

“Investment bankers and issuers are confident that there is enough liquidity for large issues to go through. Some of the block deals we have seen in the recent past is testament to that,” said Pranav Haldea, Managing Director, PRIME Database, a primary market tracker.

Huge line-ups

IPO filings are likely to pick up pace till mid-August as firms try to ensure that their last filed audited numbers are not older than 135 days, and there may be a huge line-up of offerings closer to Diwali, said market watchers.

“The average issue size may be 2-3x of what we saw last year,” said Pranjal Srivastava, Partner – Investment Banking at Centrum Capital. “Domestic flows remain robust; the secondary markets are on a roll and there are no visible signs of a slowdown. If foreign flows pick up pace, we could see a record year for IPOs.”

FPIs waiting on the sidelines before the elections may be keen to deploy money into large IPOs. Last fiscal, FPIs subscribed to 25 per cent of the issue amount as anchors and qualified institutional buyers compared with a subscription of 16 per cent by mutual funds, according to PRIME Database.

“Larger deals require sizeable FPI participation as well,” said Haldea.

Despite lofty valuations for listed peers, it has been a buyer’s market, with investors setting the price for companies about to go public. This may change if the euphoria builds up around the larger issues, said Srivastava, enabling companies to command good pricing.

Fund flows

The larger offerings may also help channelise some of the domestic and foreign flows that have been chasing the same listed names, driving up valuations. Mutual funds alone have been getting in excess of ₹20,000 crore every month through systematic investment plans.

“Most of the institutional money in the secondary market flows to the top 100-150 companies. Some of the upcoming IPOs shall help in improving the breadth of investible paper,” said Haldea.

Crime Today News | Markets | Commodities | Forex | Stocks

Source | Powered by Yes Mom Hosting

Crime Today News Agency