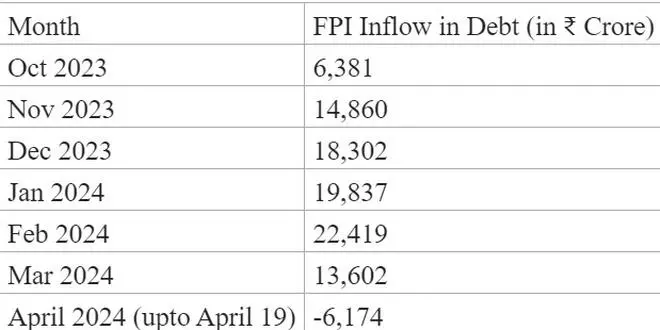

After six months of strong buying and consistent monthly inflows, Foreign Portfolio Investors (FPIs) shifted their strategy in April, becoming net sellers in the debt market. to the tune of â¹6,124 crore as of April 19.

Despite the recent outflow, FPIs have invested a net amount of â¹49,684 crore in the Indian debt market this calendar year, according to depository data.Â

FPIs have been front-loading their investments into Indian sovereign debt ahead of its inclusion in J P Morganâs flagship index, the GBI-EM Global Diversified index starting in June this year.

NET SOLD EQUITIES TOO

In April, FPIs have turned net sellers in equities, with outflows of â¹5,254 crore as of April 19, influenced by heightened geopolitical tensions and rising U.S. bond yields impacting their interest in Indian equities, depository data showed.Â

Escalating tensions from the Iran-Israel conflict in the Middle East this past week and a substantial surge in U.S. bond yields prompted FPIs to dump equities worth â¹ 20,000 crore in just four trading sessions.

FPIs had net sold equities worth â¹25,744 crore in January 2024 but made a reversal with net investments of â¹ 1539 crore and â¹ 35,098 crore in February and March 2024, respectively. Overall, the total equity net investments by FPIs till April 19 this calendar year stood at â¹ 5,639 crore.

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said âA major trend in FPI activity this month is that FPIs have turned sellers into debt after sustained buying for several months.â

From April through 20th, FPIs sold debt worth â¹ 12885 crores. This is the consequence of the rising U.S. bond yields and the concern regarding rupee depreciation, he added. The debt investment through the primary market stood at â¹6,711 crore, taking the net debt flows in April through 19th to (-) â¹6,174 crore (net outflow).

On equities, Vijayakumar noted that FPIs have in April through 19th sold equities worth â¹ 13546 crores. The hotter-than-expected US inflation and the consequent spike in bond yield (the 10-year rising above 4.6 percent) led to big selling in the Indian cash market, he said.Â

Now, the total FPI flow so far in April has dwindled to (-) â¹ 5,253 crore. âThis kind of big selling happens whenever the US bond yields spike beyond expectationsâ, Vijayakumar said.

On the portfolio changes by the FPIs, Vijayakumar said that this month, FPIs have been big sellers in IT in anticipation of poor Q4 results. They were also sellers in FMCG and consumer durables. FPIs were buyers in autos, capital goods, telecom, financial services and power, he added.

GLOBAL INDICES INCLUSIONÂ

India will join the J P Morgan GBI -EM index with a 1 per cent weight in June 2024, J P Morgan announced in September last year.  The weight will increase by 1 per cent each month until 10 per cent in April 2025.Â

Also in March this year, Bloomberg Index Services announced that Indian government bonds would be added to its Emerging Market Local Currency Government Index starting January 31, 2025. Together, the inclusion in both these indices is expected to result in inflows of $20-25 billion into the Indian debt market over an 18-month period, said experts.

Foreign investors had in 2023-24 injected â¹ 1.2 lakh crore into the debt segment, marking the highest net inflows since 2014-15.

Besides the inclusion of Indian debt in J P Morgan government bond index, the other significant event eagerly awaited by the financial markets is the pivot of the US Fed to commence an interest rate-cutting cycle.

With the US inflation remaining higher than expected, indications are high that interest rates will remain higher for longer.

Market analysts and economy watchers have now pushed back the anticipated timeline for the earliest cut from previously expected June 2024. Also, the earlier forecast of three rate cuts for the year has been trimmed down to two.

Crime Today News | Markets | Commodities | Forex | Stocks

Source | Powered by Yes Mom Hosting

Crime Today News Agency