<!–

–>

Economic inequality must be addressed with wider access to education, infra development, reforms and rural job creation etc

Published Date – 29 April 2024, 11:54 PM

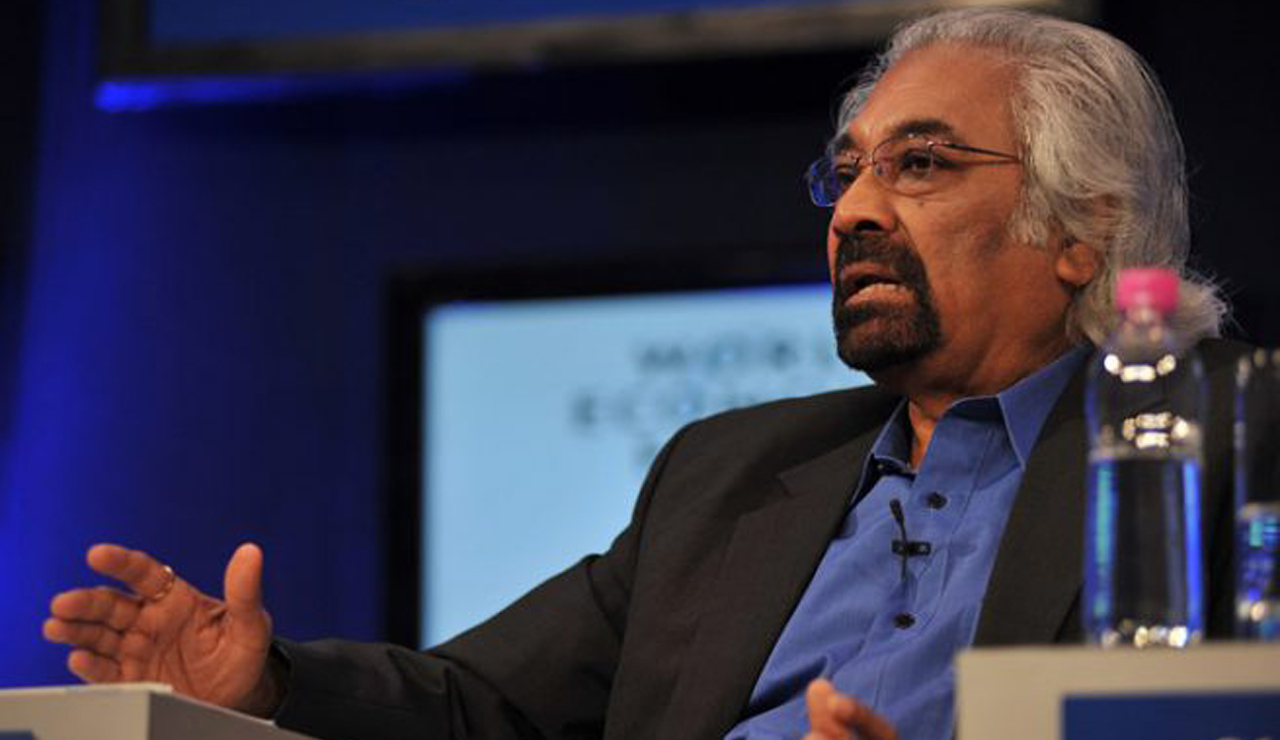

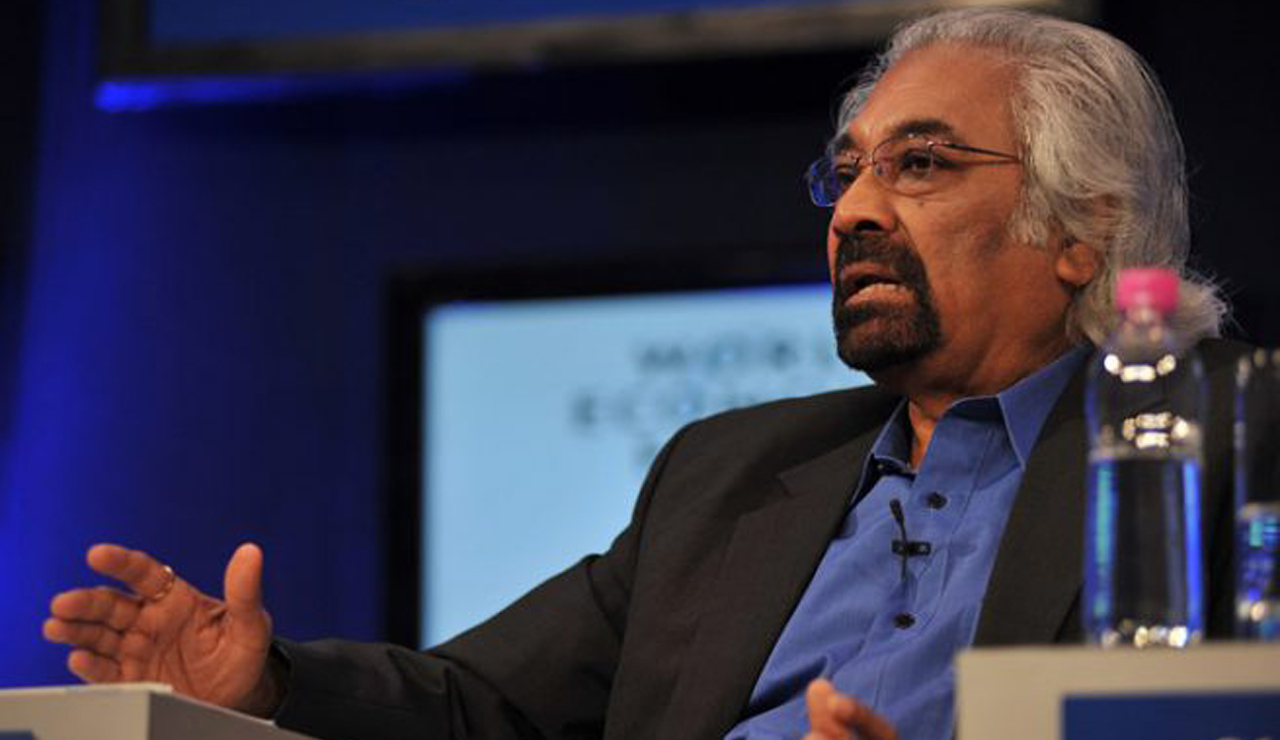

Growing wealth inequalities and shrinking opportunities for the youth are the harsh realities of India. But the imposition of inheritance tax will turn out to be a cure worse than the disease. The idea of taxing inherited wealth has triggered a political furore in the ongoing election campaign for the Lok Sabha elections. This was probably the first time that a taxation issue has become a polarising theme in electioneering, with both the BJP and the Congress accusing each other of reviving the controversial idea. It is rather surprising that inheritance tax should engage political attention in a developing nation like India which is in the middle of healthy economic growth. Chairman of the Indian Overseas Congress Sam Pitroda’s remarks in favour of a US-style tax policy for inherited wealth sparked the controversy. While the Congress has quickly dissociated itself from the observations treating them as his personal views, Prime Minister Narendra Modi and his party colleagues latched on to the issue to project the grand old party as a villain out to snatch the wealth of people even after their death. This has only added fuel to the fire on the controversial Congress’ promise of redistribution of wealth in the country. The Prime Minister himself has given it a malicious touch by alleging that the Congress was planning to redistribute citizens’ wealth among Muslims. In public meetings in Rajasthan’s Jalore and Banswara constituencies, he claimed that the Congress would conduct a survey to find out the property of individuals and then redistribute it “among those who have a large number of children… and among the intruders” – a derogatory reference to the Muslim community.

Though economic inequality is a major concern for India, it needs to be addressed with varied mechanisms such as wider access to education and skill development, easy access to finance for a wider entrepreneurial class, infrastructure development, removing supply chain bottlenecks, agricultural and land reforms and rural job creation. There is no economic justification for levying inheritance tax. International experience shows that inheritance taxes have failed to achieve the stated objectives and their collections are also below par. The loopholes and the administrative costs involved in implementing inheritance tax outweigh the benefits of economic equality. Developed countries such as the US are at a different stage of their economic journey, backed up by a robust social security framework. India needs a framework which boosts investments, entrepreneurship, wealth creation and a moderate rate of tax-promoting compliance. It may be prudent not to get carried away by the imperatives of developed economies and instead focus on our own priorities. India too had inheritance tax in the form of Estate Duty, which faced severe public opposition with its rates reaching up to 85%. It was finally abolished in 1985 by the then Rajiv Gandhi government.

<!–

–>

Source | Powered by Yes Mom Hosting