Block and bulk deals have shown a phenomenal increase in the current fiscal year so far, with the combined sell-downs tripling from year ago to over ₹25,500 crore, as promoters and strategic investors took the opportunity to exit their investments in Indian companies.

Sell-downs through the block deal window has risen over six times to ₹8,019 crore in FY25 year to date, according to data provided exclusively to businessline by Prime Database. Transactions through bulk deals were 2.4 times of last year at over ₹17,500 crore.

Block deals are a private arrangement between a single seller and buyers and are transacted in a separate window of the exchanges with a minimum transaction size of ₹10 crore. There are two block deal sessions, one in the morning and one in the afternoon each of 15 minutes duration. Bulk deals involve transactions where at least 0.5 per cent equity of a company changes hands.

Key deals

In early April, Bain Capital sold its entire stake of over 1 per cent in private sector lender Axis Bank in a block deal for around ₹3,575 crore. That was one of the big deals this year. Buyers included a host of private equity firms, global pension and retirement funds, emerging markets funds and mutual funds in India and overseas.

Later that month, British hedge fund Marshall Wace sold stakes in around 21 companies in India for over ₹2,300 crore. It sold stake worth ₹853 crore in Bank of Baroda, over ₹400 crore worth of Canara Bank shares and stake worth ₹220 crore in Bandhan Bank.

In the last week of April, Canada Pension Plan Investment Board sold shares worth ₹909 crore in logistics firm Delhivery which was again snapped up by a host of global funds including funds associated with Fidelity and HSBC.

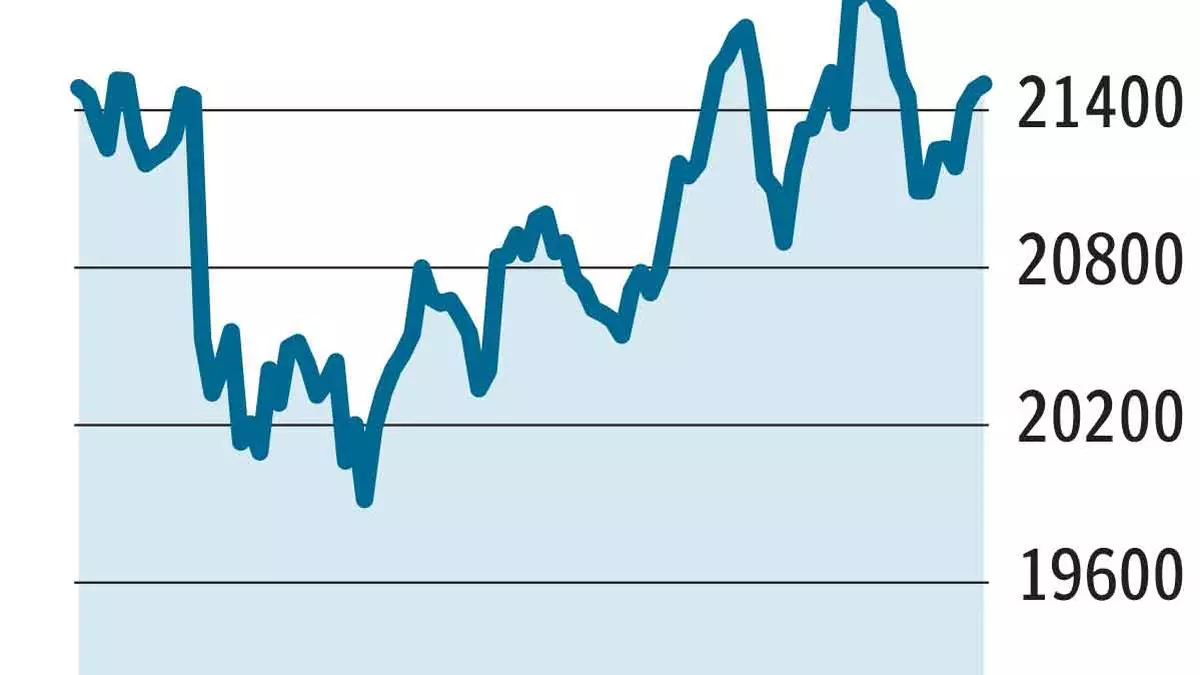

Block deals have become a significant feature of Indian stock market over the last couple of years. In FY23 block deals hit a record ₹1.87-lakh crore and last year it was around ₹1.7-lakh crore. As the numbers show the current fiscal year has got off to a brisk start.

“The exits coming just before the election verdict and markets at all-time highs may indicate earlier investors looking to reduce exposures from certain stocks or sectors,” said Arvinder Singh Nanda, Senior Vice-President at Master Capital Services.

He also pointed out that there was no discernible trend among buyers and sellers as domestic and foreign institutions were participating on both sides of the trades.

Crime Today News | Markets | Commodities | Forex | Stocks

Source | Powered by Yes Mom Hosting

Crime Today News Agency