Net Foreign Portfolio Investment (FPI) inflows into Indian equity and debt market at $41.6 billion (cumulative) in 2023-24 were the highest since 2015-16, according to an article in RBI’s latest monthly bulletin.

During 2023-24, the debt segment saw net inflows of $16.4 billion, marking the highest influx since 2018-19. Net FPI inflows in the equity segment amounted to $25.3 billion, ranking highest among emerging market peers, according to the article “State of the Economy” compiled by RBI officials.

FPI flows to India remained positive in March 2024. Net FPI inflows were at $6.7 billion in March 2024, with inflows in both equity ($4 billion) and debt ($2.7 billion) segments.

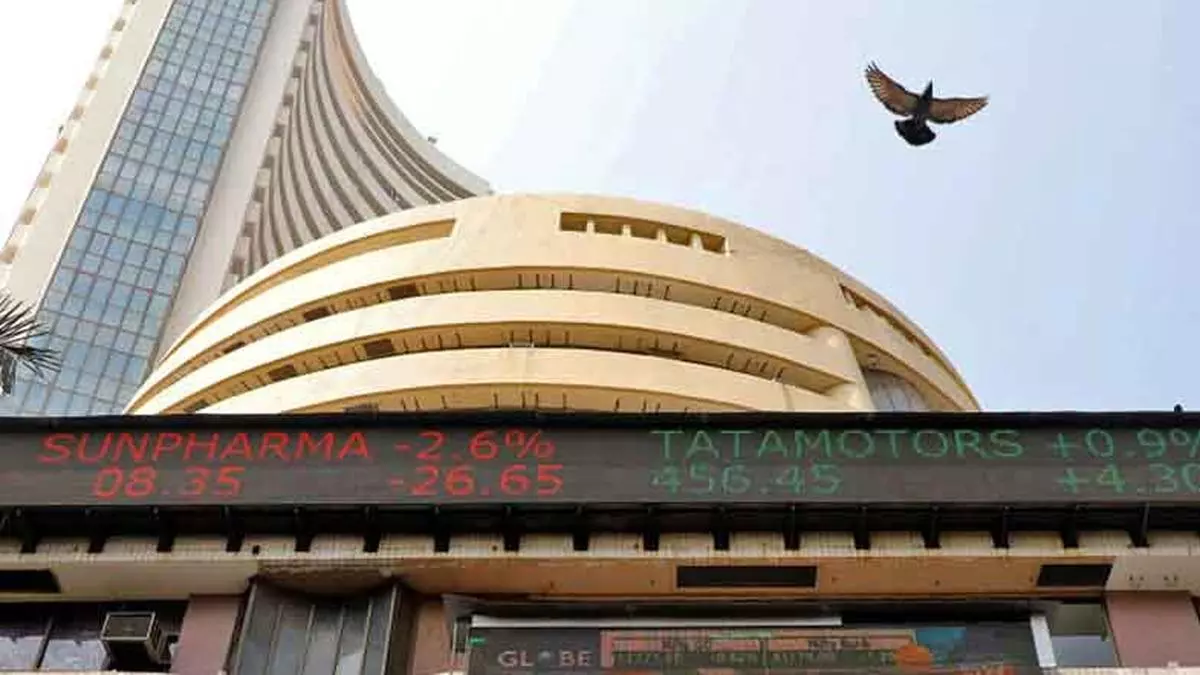

“Domestic equity markets declined initially during the second half of March amidst caution ahead of the Fed’s monetary policy decision but recovered subsequently following dovish signals from the US Fed. Equity markets witnessed stellar gains in 2023-24 across sectors, with realty and PSU indices registering the maximum gains,” the officials said.

The officials noted that markets started the new financial year on a positive note and scaled fresh highs amidst strong domestic and global macroeconomic readings along with optimism over the corporate earnings season. However, markets declined thereafter, tracking negative global cues following higher-than-expected inflation figures in the US and escalation of geopolitical tensions in the Middle East. Overall, the BSE Sensex increased by 0.6 per cent since March 15, 2024 to close at 73,088 on April 19, 2024.

infra investing

The authors observed that India has been a late adopter of real estate investment trusts (REITs) and infrastructure investment trusts (InvITs).

However, the market is flourishing – REITs and InvITs have mobilised ₹1.3-lakh crore since 2019-20 (up to March 2024). March witnessed the listing of an InvIT, which raised ₹2,500 crore through a public issue, attracting substantial interest from foreign investors.

Crime Today News | Markets | Commodities | Forex | Stocks

Source | Powered by Yes Mom Hosting

Crime Today News Agency