India’s Middle Class Crisis

Stagnant Salaries, Rising Debt, and a Dream in Peril

By Naveed Uddin Khan Uzair

India’s Finance Minister, Nirmala Sitharaman, recently tweeted about the impressive growth in GST collections. According to her, GST has increased by 12.6% from last year, with net GST reaching 2.09 lakh crore—a rise of 9.1% from the previous year. She celebrated this achievement as a sign of India’s growing economic power. But amidst the numbers and percentages, a crucial question remains unanswered: Why is India’s middle class not feeling this economic boom?

While the government flaunts record-breaking tax collections, the reality for the average Indian household tells a different story. Data from the Reserve Bank of India (RBI) reveals a disturbing trend: household debt has surged from 35% of GDP in March 2020 to a staggering 43% by June 2024. Net household savings have plummeted to their lowest in 50 years, with no signs of recovery in 2025. Rising food inflation and stagnant salaries have squeezed middle-class families to the breaking point, making them struggle to meet even basic living expenses.

Stagnant Salaries & Job Market Crisis

The JobSpeak Report highlights an 8% decline in white-collar hiring over the past two years, even as the number of graduates seeking jobs has risen by 20%. The IT sector, once the beacon of India’s middle-class aspirations, has seen a 20-30% drop in hiring. Despite rapid advancements in technology, freshers in the IT sector are still joining major companies with salary packages unchanged for the past 10 years.

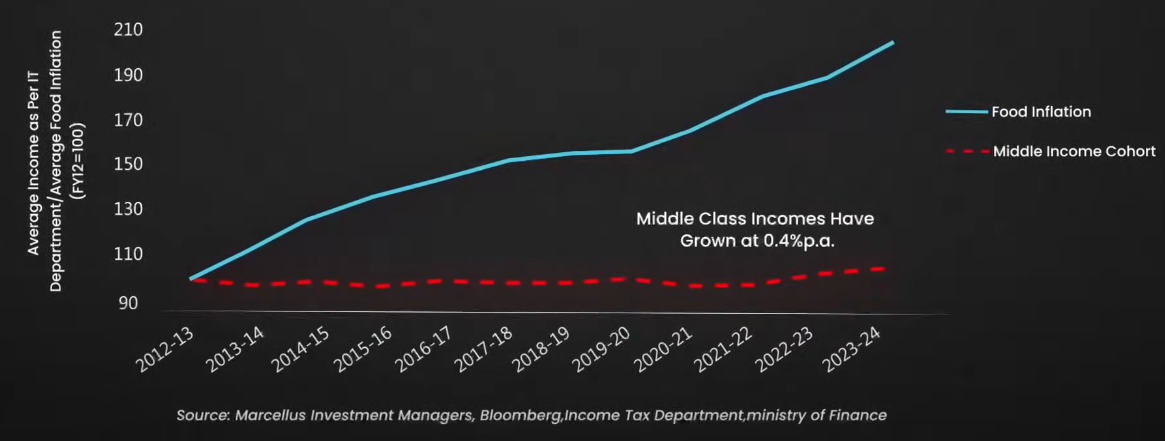

Saurabh Mukherjee, the founder of Marcellus Investment Managers, shared an eye-opening analysis of the Indian middle class. According to him, in real terms, the purchasing power of India’s middle class has halved over the last decade. As a result, consumption patterns have fallen sharply, with sales of even basic goods like soap and biscuits declining—a clear indicator of financial strain.

The Debt Trap

Household debt has spiraled out of control. From 2021 to 2024, personal loans and retail credit increased by 70%, pushing many middle-class families into severe debt. RBI’s Financial Stability Review stated that 25% of borrowers now juggle multiple loans, including housing and personal credit. Today, the average middle-class family spends 33% of their monthly income on EMIs. Many have mortgaged their gold—often a last resort in Indian society—to meet financial obligations.

Banks have become aggressive in debt recovery, sending collection agents to the homes of defaulters. Families are forced to sell properties or take new loans to repay existing ones. Unlike the ultra-rich who can escape with massive fraud, the middle class is left fighting to survive under crushing debt.

The Employment Crisis: A Time Bomb Waiting to Explode

Unemployment among India’s middle class is rising. Before COVID-19, the unemployment rate was 15%, but it has now jumped to 19-20%, according to CMIE data. Even those who manage to find jobs face long hours with minimal pay increases, stripping away the economic power they once had. If this trend continues, it could become an economic time bomb, threatening not only middle-class families but the stability of India’s entire economy.

Is There a Political Will to Change Things?

Despite these alarming trends, the government’s relief measures seem minimal. The corporate tax cut of 2019 boosted CEO salaries, but did little for job creation. The Make in India initiative aimed to push manufacturing from 18% to 25% of GDP, but instead, it has fallen to 14%. India continues to trail behind Vietnam, Laos, and Cambodia in the China Plus One strategy, highlighting a lack of competitive manufacturing.

The middle class, despite being the backbone of India’s economic structure, is often overlooked in policy decisions. While corporate taxes are slashed, the middle class is burdened with rising GST rates and fuel prices.

The Path Forward: Financial Protection & Awareness

Amidst this financial turmoil, middle-class families are urged to safeguard their finances through term and health insurance. With rising medical costs and unpredictable job markets, a financial safety net has become more crucial than ever. Investing in health insurance starting at just ₹300-400 per month can provide coverage up to ₹1 crore, while term insurance can ensure family protection with premiums as low as ₹600-700 per month.

Conclusion

India’s middle class, once a symbol of growth and prosperity, now teeters on the brink of financial collapse. With mounting debt, stagnating salaries, and limited job opportunities, their economic dreams are rapidly fading. If the government does not address these structural issues, the economic backbone of the nation could crumble, impacting not just families but the country’s long-term growth.

The question remains: Who will step up to revive India’s middle-class dream?

Published by Crime Today News | Copyright © 2025