- Thursday

- April 25th, 2024

- Submit Post

[ad_1] Washington, DC – Chants of “free Palestine” were interrupted by ululating and cheers as dozens of Georgetown University students arrived at a protest at the neighbouring George Washington University (GW) campus in the heart of the US capital city....

[ad_1] Former United States President Donald Trump saw two of the four criminal cases against him move forward on Thursday. In New York, Trump was again in court in a case connected to hush money payments made to adult film...

[ad_1] View gallery Image Credit: Getty Images Princess Kate has the world’s support as she continues treatment for her cancer battle. The 42-year-old royal was reportedly given gifts from a local high school in the U.K., and her husband, Prince...

[ad_1] NewsFeedStudents from Sorbonne University are calling on the French government to help Palestinians. Those protesting in support of Palestine say they want their demonstrations to have the same impact as those taking place across US university campuses.Published On 25...

[ad_1] View gallery Image Credit: Getty Images Joey Fatone could have added Entourage to his television credits, he exclusively told Hollywood Life. While promoting his latest partnership with Skrewball Whiskey, the original peanut butter whiskey, the NSYNC band member, 47,...

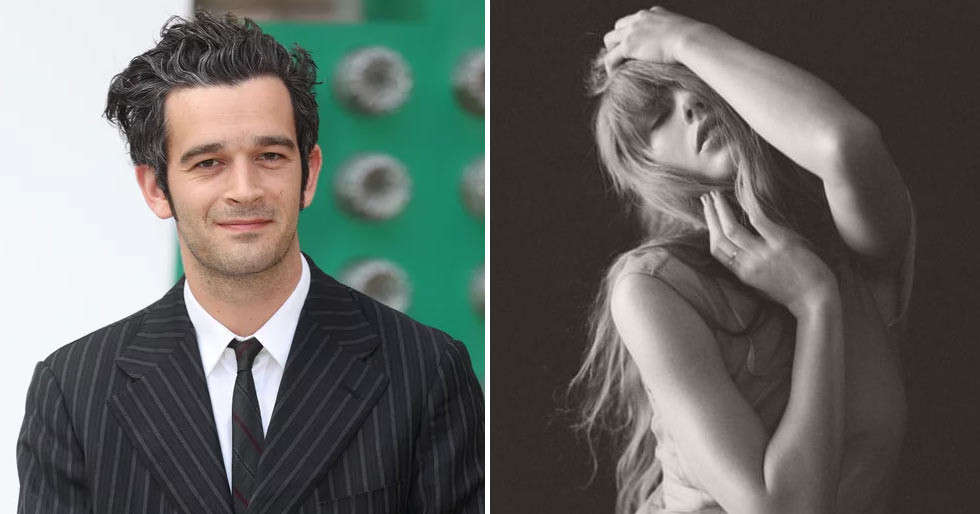

[ad_1] View gallery Image Credit: Perry Knotts/Getty Images Taylor Swift’s latest album is beyond Donna Kelce’s wildest dreams. After the Grammy winner released The Tortured Poets Department on April 19, Taylor, 34, is receiving a rave review from boyfriend Travis...

[ad_1] NewsFeedA ship with aid workers from 40 countries is hoping to leave a Turkish port on Friday and deliver 5,000 tons of much-needed aid to Gaza.Published On 25 Apr 202425 Apr 2024 [ad_2] Crime Today News | World Source...

[ad_1] Manisha Koirala has recently spoken about the three biggest Khans of Bollywood. During an interview with Zoom, Koirala shared her thoughts about Shah Rukh Khan, Salman Khan, and Aamir Khan. Manisha Koirala has worked with Shah Rukh Khan in...

[ad_1] Riddhima Kapoor Sahni has recently shared how Alia Bhatt supported her family after Rishi Kapoor's demise. During an interview, the businesswoman noted that Bhatt was consoling her family, especially her mother Neetu Kapoor, when Rishi Kapoor passed away. She...

Loading posts...

Loading posts...  All posts loaded - Crime Today News

All posts loaded - Crime Today News

No more posts